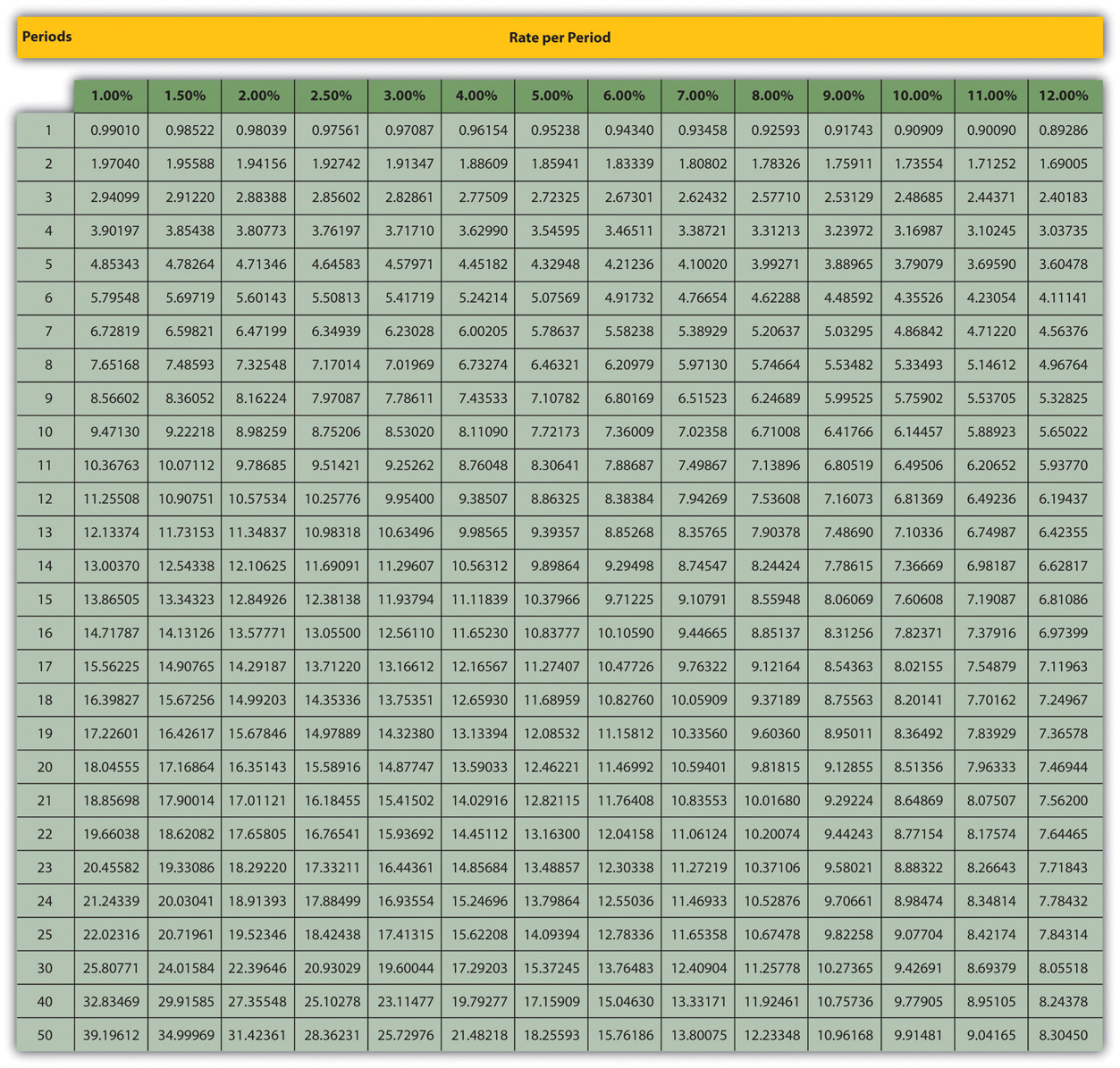

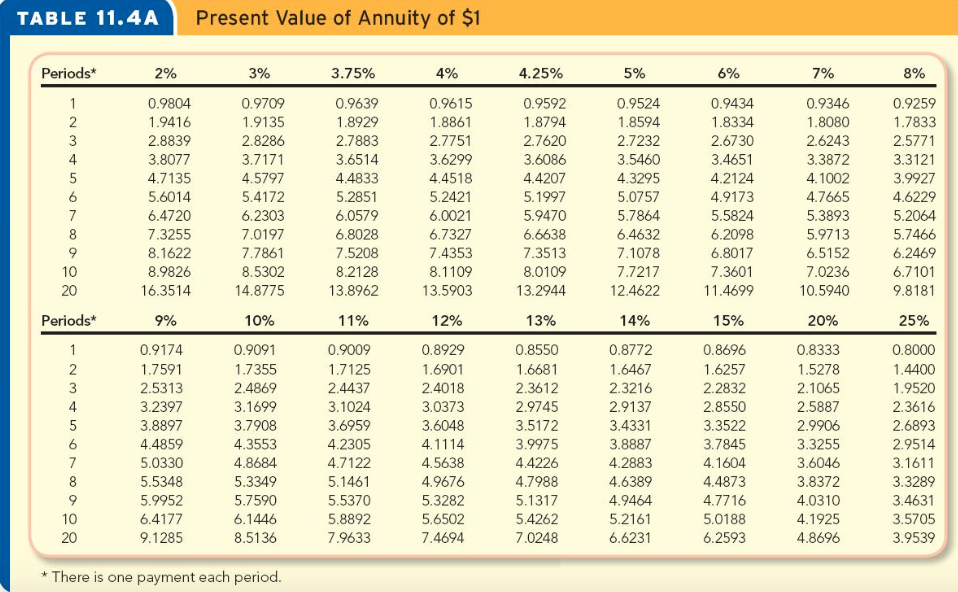

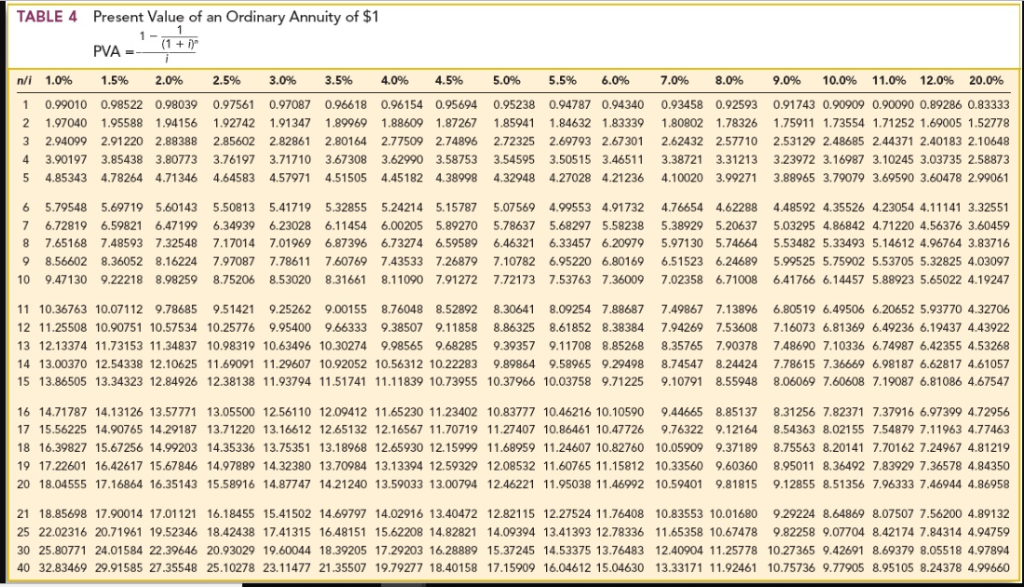

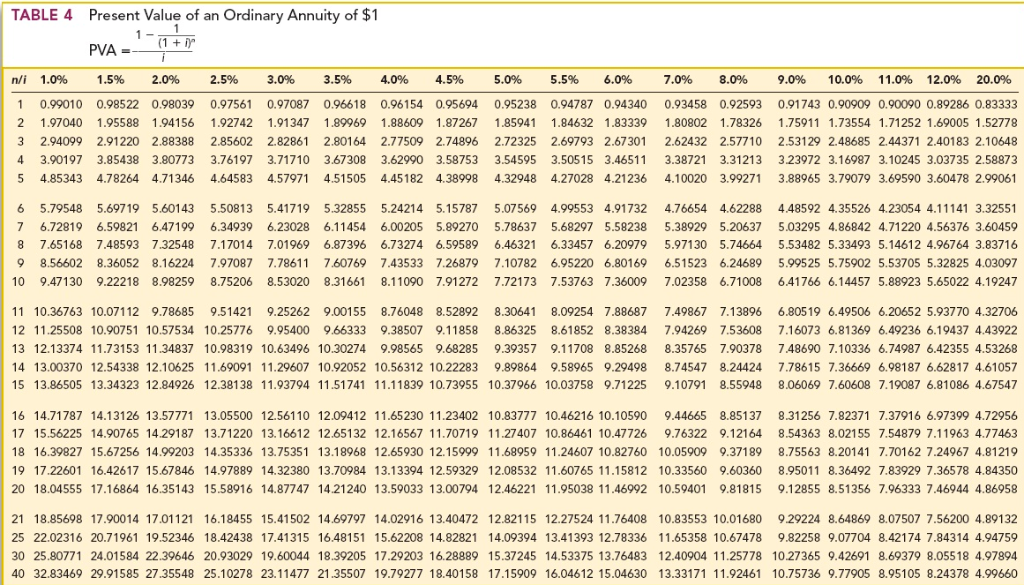

Present value of annuity table of $1

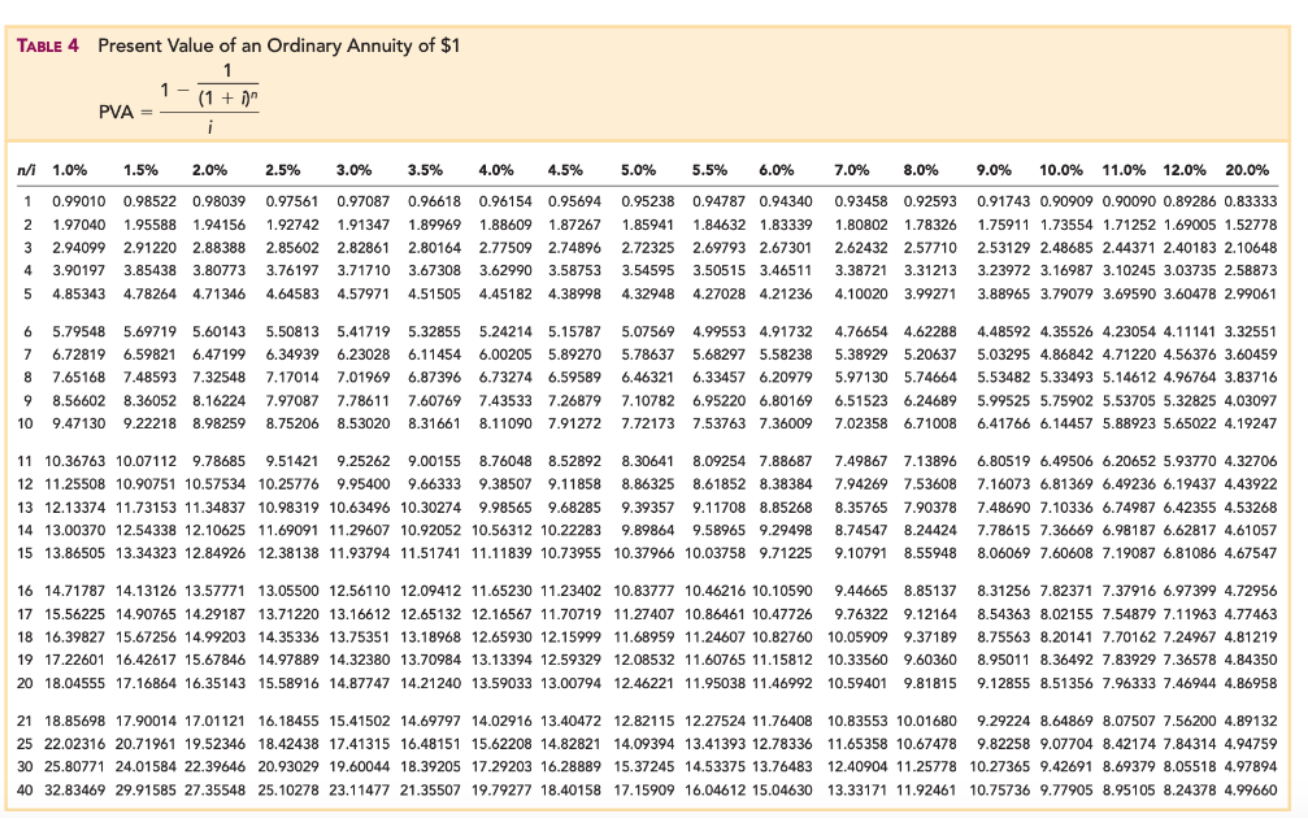

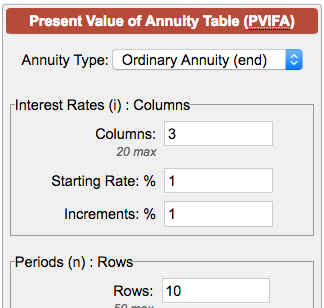

More study material from this topic. 153 rows The following present value of annuity table 1 per period n at r for n periods will also help you calculate the present value of your ordinary annuity.

Appendix Present Value Tables Financial Accounting

The annuity is the principal and interest payments you make every.

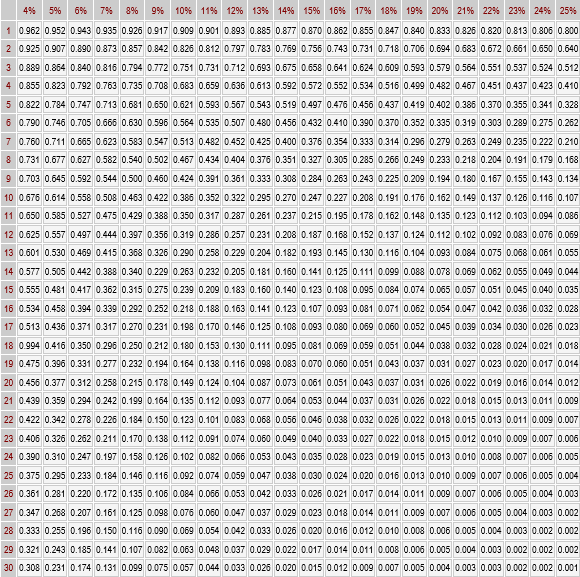

. Using The Discount Rate For The Present Value Interest Factor. Present Value Of 1 Annuity Table. Average rate of return or accounting rate of return method.

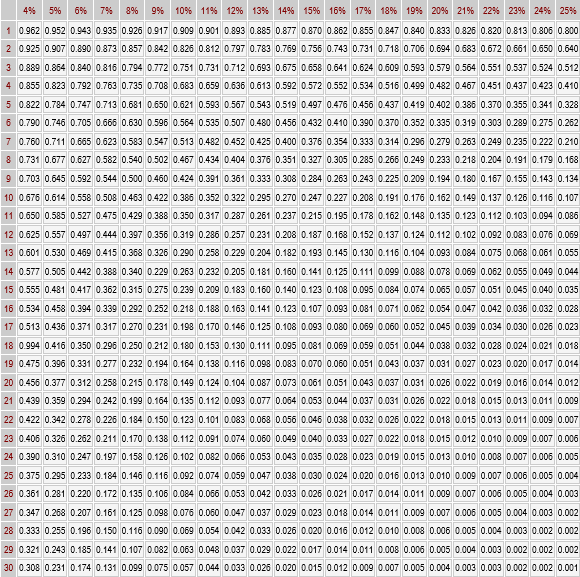

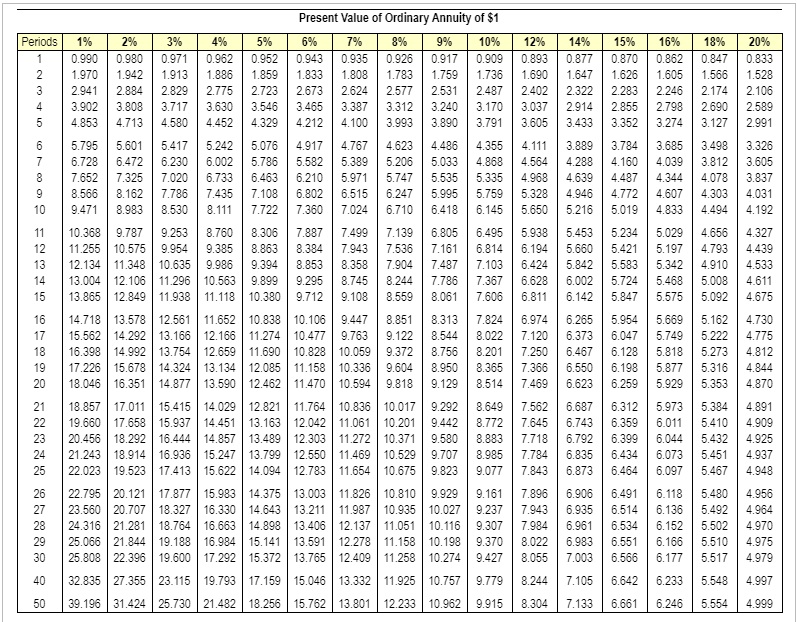

This table contains the present value of 1 to be received. Difference Between Pv Annuity And Pv Of 1 Tables. PVIFA stands for the present value interest factor of an annuity.

Accordingly use the annuity formula in an electronic spreadsheet to more precisely calculate the correct amount. Example PageIndex investigates and develops an efficient way to calculate the present value of an annuity by relating the future value of an annuity and its present value. Semiannual coupon payment face value c.

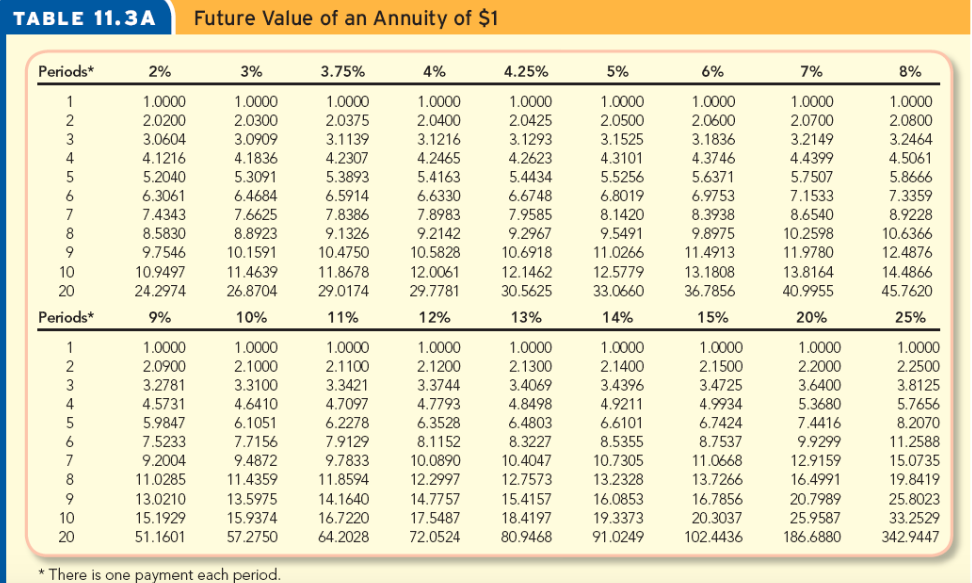

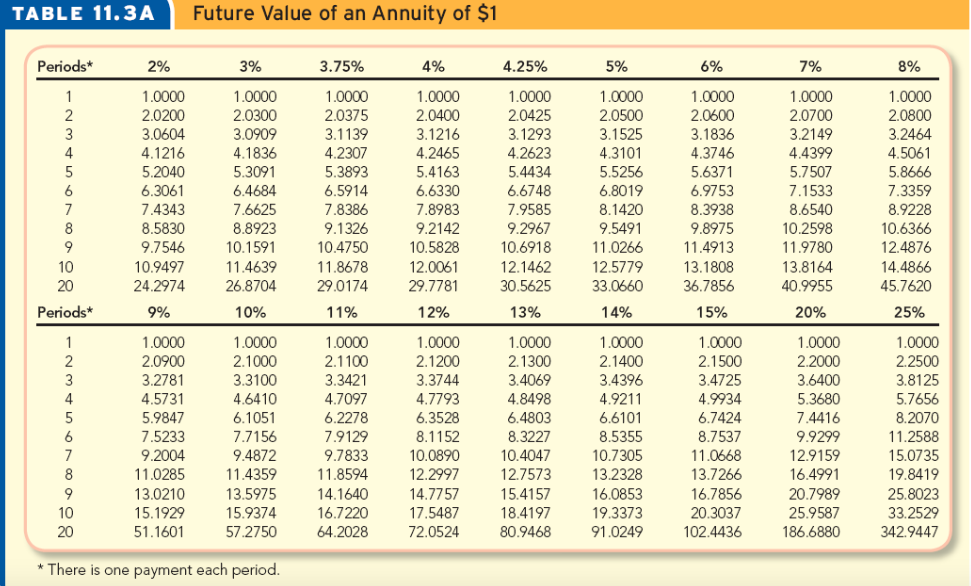

Present Value Of Annuity Formulas In Excel. The present value of the annuity is calculated from the Annuity Factor AF as. The total of all payments compounded for the appropriate number.

AF x Time 1 cash flow. Ad Learn More about How Annuities Work from Fidelity. The model of IP growth over the years X was found to be new IP 9040x 820 with coefficient of.

Ad Annuities are often complex retirement investment products. Mr Fieldman is planning his estate and present value of annuity table wants to leave his son some money. Learn some startling facts.

Therefore the interest rate is 2 quarterly or 8 annually. This enables the compa ny to acquire new IP at a reduced cost than its market worth. Related Present Value Annuity Due Calculator Future value of a.

Ad Learn More about How Annuities Work from Fidelity. Present value of an annuity. It may be labeled Present Value of and Annuity of 1.

Deja un comentario Bookkeeping Por paguilera. It is used to calculate the present value of any single amount. What Is Present Value Of.

Get this must-read guide if you are considering investing in annuities. Alternatively we can compute present value of an annuity using present value of an annuity of 1 in arrears table. Determine the present value of 200000 to be received at the end of each of four years using an interest rate of 7 compounded annually as follows.

It is a metric that can be used to calculate a number of annuities. Present Value of 1 Table. He can choose between an annuity of 50000 paid annually at the end of each.

The formula for calculating the present value of an. Present value of annuity table of 1. The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate.

This table shows the present value of 1 at various interest rates i and time periods n. Methods for the evaluation of capital investment analysis. 100 1 rating Price of a bond is the present value of its cash flows cash flows being the coupon payments and principal repayment at maturity.

Solved The Present Value Of 1 Table The Present Value Chegg Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Future Value Of 1 Table Accountingexplanation Com

Solved Table 1 Future Value Of 1 Fv 1 1 I N Table 3 Chegg Com

2

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Solved Table 4 Present Value Of An Ordinary Annuity Of 1 1 Chegg Com

Present Value Of 1 Table Accounting For Management

Present Value Of Ordinary Annuity Table Accountingexplanation Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Solved Table 6 Present Value Of An Annuity Due Of 1 1 I Chegg Com

Present Value Of An Ordinary Annuity Of 1 Download Table

Present Value Of An Ordinary Annuity Of 1 Download Table

Present Value Of 1 Table Accountingexplanation Com

Table 4 Present Value Of An Ordinary Annuity Of 1 Chegg Com

2

Present Value Of 1 Annuity Table